Technology Innovation Accounting Knowledge Sales Planning Leadership Solutions

Standing Stone Accounting

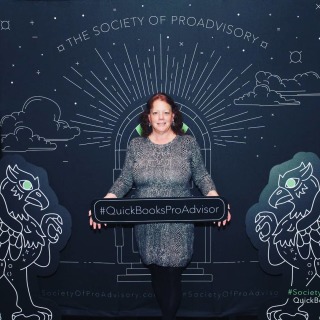

Linda Baker: Small Business Management Expert and Accounting Pro Advisor

We’re here to help small businesses grow to successful businesses, no matter what your size, and make your dreams come true. We’re helping small businesses like Architects, Repair Shops, & Trade Services.

You’re good at your business because, hey, it was your idea. It’s what you love. It’s your dream to become something better, and to share that opportunity with others who see your vision and want to be a part of it too.

But then there’s this accounting stuff that IRS and the State governments want you to do just to prove how good you are at your business…and the laws they make. So how do you do all of that, when you don’t even know what they’re talking about?!

Well, there’s this thing called GAAP, (Generally Accepted Accounting Principles), accounting standards, and this is what IRS wants you to follow. Bankers, investors & buyers are going to want you to have your books in this order so that they can analyze how well your business is doing & compare you to others in your industry.

As you can see, posting transactions into your software is not that simple and we can’t rely on AI to post it correctly. You need someone that understands the rules & laws so that the transactions are recorded correctly. Doing them wrong can cost you more in income tax paid to IRS. This is why you should look for an accountant with accounting degrees, experience and current knowledge of how to make sure your books are posted to give you the best tax advantage.

A couple of common mistakes:

- Posting refunds as Income from insurance, vendor purchases (like Lowe’s or Home Depot). These are not income. They should be posted back to the expense account that they were paid out of, like Worker’s Comp. Ins. Or Cost of Goods-Supplies.

- Posting deposits as Income for jobs that have not been started yet. These are Liabilities until the job gets started, then moved to Income.

- Posting the net payroll as an expense to Wages. Each payroll needs to be broken down between wages, deductions/reimburements, and taxes. The net amount is what comes out of the bank account.

- Posting loan payments as Expenses. Vehicle and bank loan payments should be posted to a Liability account where you can track the balance due. When you purchase a vehicle, the market value needs to be posted as an Asset and set up the loan as a Liability account.

- Posting money that you deposited into the company bank account as Income so that you could pay bills. This is not Income, it is either a Shareholder Equity contribution or a Shareholder Loan.

We offer your accounting done in: Xero or Intuit’s QuickBooks Online

![]()

As a member of the American Institute of Public Bookkeeping and other professional groups, Linda remains at the forefront of technology, accounting standards, tax notifications, and payroll procedures. She regularly attends conferences, training sessions, and keeps herself informed through relevant publications.

Linda Baker, the driving force behind Standing Stone Accounting, is a seasoned Small Business Management expert with an impressive track record spanning over 40 years in various industries and comes highly recommended by her current & past clients. Linda brings a wealth of experience and knowledge to the table, ensuring your business's financial success. She holds an Associate's Degree in Business Management, a Bachelor's Degree in Accounting, and boasts certifications as a Certified Bookkeeper and Certified QuickBooks Pro Advisor & Xero Certified Advisor.

Our mission is to help others succeed in their business!

See what others say about working with Linda and what she has done for others. Look at the Testimonies below and on the LinkedIn profile.

“I highly recommend Linda Baker from Standing Stone Accounting as a QuickBooks trainer. She presented several QuickBooks trainings at the Cecil County Public Library and participants inquired regularly when she would be back to present again. Whether the participants were new to QuickBooks or advanced users, all received valuable information from her presentations. The handouts she provided enabled users to take the key information home with them, to practice and apply the knowledge gained to their own QuickBooks accounts. Ms. Baker successfully manages to present her vast knowledge of QuickBooks in an easy to understand, accessible format to an audience of both start-ups, seasoned entrepreneurs, and non-profits alike.”

Laura Metzler, MLS

Senior Business Research Librarian

Cecil County Public Library

Standing Stone Accounting, LLC, founded by Linda Baker, is more than just a bookkeeping service; it's a one-stop financial hub. They offer comprehensive services and advisory support, including sales advice, cash flow analysis, expense management, payroll solutions, business management advisory. Linda is a Certified Xero Advisor & QuickBooks Online ProAdvisor with degrees in Business Management and Accounting.

Essentials/Monthly Review Accounting

A monthly service that will give you the oversight of your accounting, do a monthly bank reconciliation, and make necessary corrections to your transactions so that they are in order for doing your taxes, help with business analyzation, & used for loan help. This service is at a reduced price for Small Business owners that do their own bookkeeping but are not aware if they are doing it correctly. Priced per hour, as needed, starting at $65 per hour.

If you already have your QuickBooks or Xero file started, we can provide you with a review of your books to let you know if everything looks like it's being done properly and your accounts are set up correctly for taxes.

Don’t have an accounting software program or way to track your business transactions? I can help you get set up with the most popular accounting solutions online - QuickBooks Online or Xero.